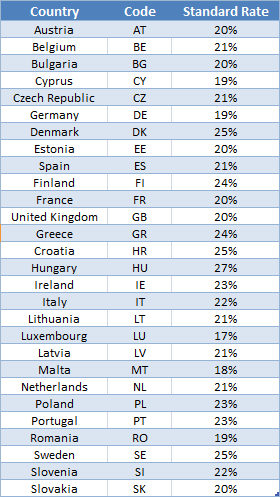

A Guide to the European VAT Directives 2019: Ben Terra, Julie Kajus: 9789087225162: Amazon.com: Books

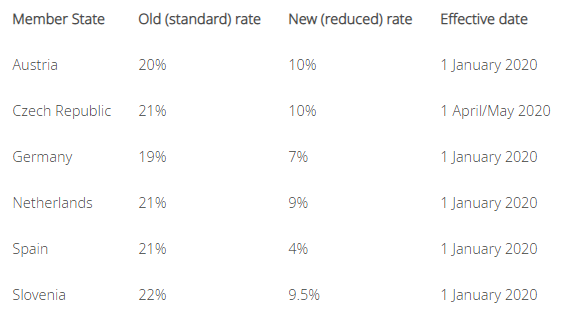

Germany: VAT rate reduced from 19 to 16 percent and tax rate will drop from 7 to 5 percent between July 1 and Dec 31, 2020. German VAT - Global VAT Compliance